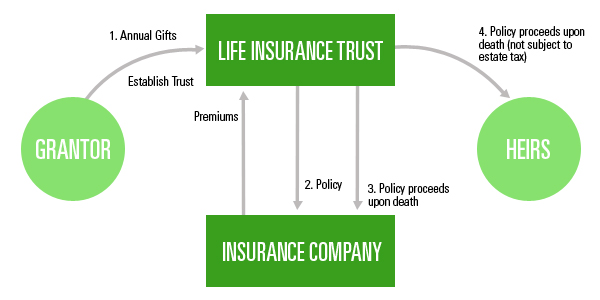

Thankfully, most of the life insurance suits enjoy the statutory protection provided by the state governments but again, their protection depends on the applicability of state law. Anyone who owns a life insurance policy might have heard of the term ILIT i.e. irrevocable life insurance trust. ILIT refers to an irrevocable trust which is particularly designed to own life insurance and in case of other trusts; ILIT has a definite trustee, terms and beneficiary. For example, when a person having life insurance is dead, the insurer pays a pre-decided amount to the beneficiary. In such a case, ILIT could be both- funded and non-funded.

Funded and Non Funded ILIT:

In case of a non-funded ILIT, the life insurance premiums are not fully paid to the beneficiary but the future insurance are paid to the trustee who then takes the complete ownership of the following premiums. On the other hand, funded ILIT gives the benefit of either providing the complete future funds to the trustee or it helps them with enough funds and income producing asset that helps them in paying their future premiums. So whether the premium is funded or it is not, one thing which is clear is about the policy premiums that belong to the trustee. Below is the list of things that you need to consider while understanding ILIT:

- ILIT is irrevocable due to which it protects the policy's cash value, trust distribution and death proceeds. A person cannot serve as a trustee of a trust for 2 definite reasons- 10 if the trust belongs to an irrevocable genre and 2) when acting as the trustee gives you the incidents of ownership to retain control ultimate over the policy.

- In case the life insurance policy is not protected under the state law, then an ILIT become necessary. For an irrevocable life insurance trust, anyone can play a trustee which includes your spouse, kids, business partner, financial institution, attorney and so on.

- ILIT in itself owns personal insurance and thus, it can help in saving your estate taxes. If you are looking for some asset protection services or attorney, then know how ILIT can become a big part of your saving structure.

- If you are the owner of the policy, you can anytime withdraw the cash value or change the beneficiary. You can do it anytime in your life.

- ILIT, just like a property or material, is a part of your asset. It is an asset that might bring phenomenal benefits to you in lifetime.

- Since ILIT is your asset, the IRS and state taxing authorities will include it in your estate, making it a part of estate taxes.

- If a person dies within the three years of transferring the policy which is under ILIT, then the IRS will still include the estate proceeds within the tax purposes. Keep the trust funded with enough money and policy purchased on your life to avoid any type of complications.

Liberty Street Advisory Group Offers asset protection services refers to the separate entities, Liberty Street Law, Liberty Street Capital and Trust & Estate Stewards. None of these entities or persons furnish actuarial, accounting or comprehensive tax advice. Liberty Street Capital, is a limited liability company registered as an investment advisor in Georgia and other locations. Trust & Estate Stewards is a limited liability company. Past results are not a guarantee of future performance.

Liberty Street Advisory Group Offers asset protection services refers to the separate entities, Liberty Street Law, Liberty Street Capital and Trust & Estate Stewards. None of these entities or persons furnish actuarial, accounting or comprehensive tax advice. Liberty Street Capital, is a limited liability company registered as an investment advisor in Georgia and other locations. Trust & Estate Stewards is a limited liability company. Past results are not a guarantee of future performance.