How does one legitimately pay no taxes?

If you need cash flow now then municipal bonds would be one method depending on the state you live in. In California, California municipal bond interest are not tax at the state or federal level; legitimate income without taxes.

If you can wait for the cash you can always defer paying taxes on earned income by enrolling in an IRA or employer sponsored 401(k). These will allow you to defer paying taxes and allow your money to grow. When you withdraw fund from a retirement account (once you’re in retirement) you will pay taxes on the money you originally contributed (with the expectation that you will be in a lower tax bracket in retirement verses when you earned the income) but the money that grew within the account is tax free.

Here’s an idea. Can anyone poke any holes in it?

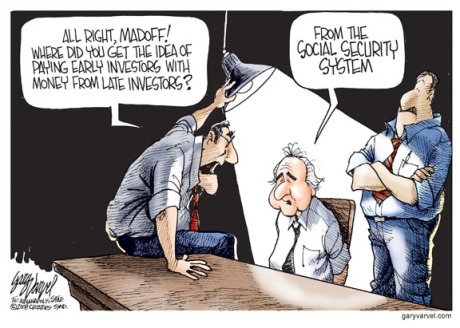

- Acquire second citizenship in a nation where the following steps may be taken legally, especially where privacy rights are respected and earnings outside the nation are not taxed e.g. Switzerland.

- Choose your favorite country which levies no corporate tax e.g. Cayman Islands. Register 1 trust and 2 separate corporations, issuing bearer shares. Bearer shares can be owned and traded anonymously like cash. As such the corporation could even be owned by a stateless person.

- Assign bearer shares for Corp1 to be held in trust by Corp2. You anonymously hold bearer shares for Corp 2 and so direct it as trustee.

- Corporation 1 is now your primary vehicle for business and earnings. This protects you on multiple levels. Corp1 is not required to pay taxes. Furthermore you don’t own it. The trust owns it. Anyone may be compensated by Corp 1 as a director, including yourself.

- Assign your family or chosen Non-Profit as beneficiary of the trust. In the event that corporation 2 is no longer able to perform its duty to manage corporation 1 as a trustee, the trust beneficiary may choose a new trustee or take ownership of corporation 1 as a distribution from the trust.

- If necessary, renounce original citizenship to avoid conflicts of law from dual citizenship.

Recent Posts

Understanding the Safety Act: Provisions, Impact, and Controversies

Main Provisions of the Safety Act The Safety Act encompasses a range of measures designed…

FMLA 2024: Can You Fire Someone While They’re on Leave?

Introduction to FMLA The Family and Medical Leave Act (FMLA) is a crucial piece of…

2024 HSA and FSA Contribution Limits: Maximize Your Healthcare Savings

In 2024, Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) will see changes in…

4 Tips for Getting through a Separation or Divorce

A separation or divorce may be a delicate, dominant turning point that will reverse your…

15 Best Strategies to Win Your Personal Injury Case

A personal injury case is complicated, exhausting, and mentally draining with employers and insurance companies…

Has the Chewbacca defense ever been used successfully in a court of law?

Yes of course. It is actually one of the oldest and most widely used defenses…