The following is a summary of Alabama divorce laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Alabama Code and/or consult with an attorney about how the law might apply to your particular situation.

Grounds for Divorce in Alabama

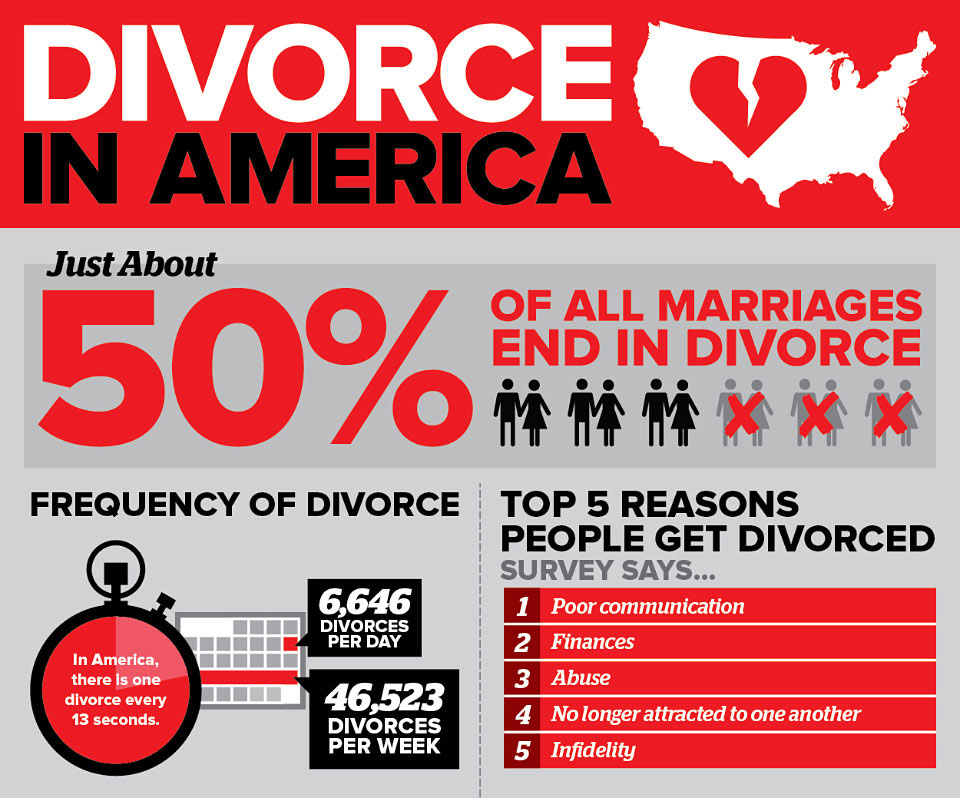

The state of Alabama shall grant a “no-fault” divorce if it finds either that there exists such a complete incompatibility of temperament that the parties can no longer live together, or that there has been an irretrievable breakdown of the marriage and that further attempts at reconciliation are impractical or futile and not in the best interests of the parties or family.

Alabama also recognizes several fault-based grounds under their statutes. The following is a brief summary of those grounds, and if you are interested in using any of these grounds, it would be in your best interests to consult with an attorney about whether your particular situation warrants filing your divorce based on such grounds, and what type of proof might be needed.

- Physically and incurably incapacitated from entering into the marriage state

- Adultery

- Imprisonment

- Crimes against nature

- Addiction

- Insanity

- Pregnancy of the wife at the time of marriage without the husband’s knowledge or agency

- Violence

- Abandonment

-From Section 30-2-1 of the Code of Alabama.

Alabama Residency Laws

Complaints for divorce may be filed in the circuit court of the county in which either spouse resides, or in the circuit court of the county in which the parties resided when the separation occurred. If the defendant does not reside in the state of Alabama, then the other party to the marriage must have been a bona fide resident of Alabama for six months before filing the complaint.

-From Sections 30-2-4 and 30-2-5 of the Code of Alabama

Waiting Period Before Divorce is Finalized in Alabama

A court shall not enter a final judgment of divorce until after the expiration of 30 days from the date of the filing of the summons and complaint. However, temporary orders (for child custody and support, alimony, etc.) can be issued during that period.

-From Section 30-2-8.1 of the Code of Alabama

Learn more about the divorce procedure

Additional Information

Following a divorce, neither party shall again marry, except to each other, for a period of at least 60 days.

-From Section 30-2-10 of the Code of Alabama

[toggle title=”Alabama Child Custody Laws”]The following is a summary of Alabama child custody laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Alabama Code and/or consult with an attorney about how the law might apply to your particular situation.

Guidelines for Child Custody Under Alabama Laws.

Upon granting a divorce, the court may give the custody and education of the children of the marriage to either father or mother, as may seem right and proper, having regard to the moral character and prudence of the parents and the age and sex of the children; and pending the action, may make such orders in respect to the custody of the children as their safety and well-being may require. But in cases of abandonment of the husband by the wife, he shall have the custody of the children after they are seven years of age, if he is a suitable person to have such charge.

-From Section 30-3-1 of the Code of Alabama

Joint Custody

It is the policy of the state of Alabama to assure that minor children have frequent and continuing contact with parents who have shown the ability to act in the best interest of their children and to encourage parents to share in the rights and responsibilities of rearing their children after the parents have separated or dissolved their marriage.

The court shall in every case consider joint custody but may award any form of custody which is determined to be in the best interest of the child. In determining whether joint custody is in the best interest of the child, the court shall consider the same factors considered in awarding sole legal and physical custody and all of the following factors:

- The agreement or lack of agreement of the parents on joint custody.

- The past and present ability of the parents to cooperate with each other and make decisions jointly.

- The ability of the parents to encourage the sharing of love, affection, and contact between the child and the other parent.

- Any history of or potential for child abuse, spouse abuse, or kidnapping.

- The geographic proximity of the parents to each other as this relates to the practical considerations of joint physical custody.

The court may order a form of joint custody without the consent of both parents, when it is in the best interest of the child.

If both parents request joint custody, the presumption is that joint custody is in the best interest of the child. Joint custody shall be granted in the final order of the court unless the court makes specific findings as to why joint custody is not granted.

-From Sections 30-3-150 and 30-3-152 of the Code of Alabama

Definitions

The state of Alabama has defined the following terms:

- JOINT CUSTODY. Joint legal custody and joint physical custody.

- JOINT LEGAL CUSTODY. Both parents have equal rights and responsibilities for major decisions concerning the child, including, but not limited to, the education of the child, health care, and religious training. The court may designate one parent to have sole power to make certain decisions while both parents retain equal rights and responsibilities for other decisions.

- JOINT PHYSICAL CUSTODY. Physical custody is shared by the parents in a way that assures the child frequent and substantial contact with each parent. Joint physical custody does not necessarily mean physical custody of equal durations of time.

- SOLE LEGAL CUSTODY. One parent has sole rights and responsibilities to make major decisions concerning the child, including, but not limited to, the education of the child, health care, and religious training.

- SOLE PHYSICAL CUSTODY. One parent has sole physical custody and the other parent has rights of visitation except as otherwise provided by the court.

-From the Section 30-3-151 of the Code of Alabama

Availability of Records

Unless otherwise prohibited by court order or statute, all records and information pertaining to the child, including, but not limited to, medical, physiological, dental, scholastic, athletic, extracurricular, and law enforcement, shall be equally available to both parents, in all types of custody arrangements.

-From Section 30-3-154 of the Code of Alabama

[/toggle] [toggle title=”Alabama Child Support Laws”]The following is a summary of Alabama child support laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Alabama Code and/or consult with an attorney about how the law might apply to your particular situation.

Determination of Income under Child Support Guidelines

For purposes of the child support guidelines, “income” means actual gross income of a parent, if the parent is employed to full capacity, or the actual gross income the parent has the ability to earn if the parent is unemployed or underemployed.

“Gross income” includes income from any source, and includes, but is not limited to, salaries, wages, commissions, bonuses, dividends, severance pay, pensions, interest, trusts, annuities, capital gains, Social Security benefits, workers’ compensation benefits, unemployment insurance benefits, disability insurance benefits, gifts, prizes, and preexisting periodic alimony.

“Gross income” does not include child support received for other children or benefits received from meanstested public assistance programs, including, but not limited to, Aid to Families with Dependent Children, Supplemental Security Income, food stamps, and general assistance.

For income from self-employment, rent, royalties, proprietorship of business, or joint ownership of a partnership or closely held corporation, “gross income” means gross receipts minus ordinary and necessary expenses required to produce such income, as allowed by the Internal Revenue Service. However, “ordinary and necessary expenses” does not include amounts allowable by the Internal Revenue Service for the accelerated component of depreciation expenses, investment tax credits, or any other business expenses determined by the court to be inappropriate for determining gross income for purposes of calculating child support.

Expense reimbursements or in-kind payments received by a parent in the course of employment, self-employment, or operation of a business shall be counted as income if they are significant and reduce personal living expenses.

If the court finds that either parent is voluntarily unemployed or underemployed, it shall estimate the income that parent would otherwise have and shall impute to that parent that income; the court shall calculate child support based on that parent’s imputed income. In determining the amount of income to be imputed to a parent who is unemployed or underemployed, the court should determine the employment potential and probable earning level of that parent, based on that parent’s recent work history, education, and occupational qualifications, and on the prevailing job opportunities and earning levels in the community. The court may, in its discretion, take into account the presence of a young or physically or mentally disabled child necessitating the parent’s need to stay in the home and therefore the inability to work.

The amount of child support actually being paid by a parent pursuant to an order for support of other children shall be deducted from that parent’s “gross income.”

-From Rule 32 of the Alabama Child Support Guidelines.

Health Insurance

All orders establishing or modifying child support shall, at a minimum, provide for the children’s health care needs through health insurance coverage or other means. Normally, health insurance covering the children should be required if it is available to either parent through his or her employment or pursuant to any other group plan at a reasonable cost.

The actual cost of a premium to provide health insurance benefits for the children shall be added to the “basic child support obligation” and shall be divided between the parents in proportion to their adjusted gross income.

-From Rule 32 of the Alabama Child Support Guidelines.

Child Care Costs

Child care costs, incurred on behalf of the children because of employment or job search of either parent, shall be added to the “basic child support obligation.”

-From Rule 32 of the Alabama Child Support Guidelines.

Split Custody

In those situations where each parent has primary physical custody of one or more children, support shall be computed in the following manner:

a. Compute the support the father would owe to the mother for the children in her custody as if they were the only children of the two parties; then

b. Compute the support the mother would owe to the father for the children in his custody as if they were the only children of the two parties; then

c. Subtract the lesser support obligation from the greater. The parent who owes the greater obligation should be ordered to pay the difference in support to the other parent, unless the court determines, pursuant to other provisions of this rule that it should deviate from the guidelines.

-From Rule 32 of the Alabama Child Support Guidelines.

Joint Custody

The Alabama child support guidelines do not specifically address the problem of establishing a support order in joint custody situations. Such a situation may be considered by the court as a reason for deviating from the guidelines in appropriate situations, particularly if physical custody is jointly shared by the parents.

-From Rule 32 of the Alabama Child Support Guidelines.

Income Over the Guidelines

The schedule of basic child support obligations includes combined gross incomes ranging from $550 to $10,000 a month. Rule 32(C)(1) provides that the court may use its discretion in determining child support where the combined adjusted gross income is below the lowermost levels or above the uppermost levels of the schedule.

-From Rule 32 of the Alabama Child Support Guidelines.

Deviation from Child Support Guidelines

There shall be a rebuttable presumption that the amount of child support calculated under the Alabama Child Support Guidelines is the correct amount of child support to be awarded. A written finding indicating that the application of the guidelines would be unjust or inappropriate shall be sufficient to rebut the presumption if the finding is based upon:

(i) a fair, written agreement between the parties establishing a different amount and stating the reasons therefore; or

(ii) a determination by the court, based upon evidence presented in court and stating the reasons therefore, that application of the guidelines would be manifestly unjust or inequitable.

Reasons for deviating from the guidelines may include, but are not limited to, the following. The existence of one or more of the reasons enumerated in this section does not require the court to deviate from the guidelines, but such reason or reasons may be considered in deciding whether to deviate from the guidelines.

a. Shared physical custody or visitation rights providing for periods of physical custody or care of children by the obligor parent substantially in excess of those customarily approved or ordered by the court;

b. Extraordinary costs of transportation for purposes of visitation borne substantially by one parent;

c. Expenses of college education incurred prior to a child’s reaching the age of majority;

d. Assets of, or unearned income received by or on behalf of, a child or children; and

e. Such other facts or circumstances that the court finds contribute to the best interest of the child or children for whom support are being determined.

-From Rule 32 of the Alabama Child Support Guidelines.

Immediate Income Withholding Order

Immediate withholding shall not be implemented in any case where one of the parties demonstrates, and the court finds, there is good cause not to require immediate income withholding, or a written agreement is reached between both parties which provides for an alternative arrangement. In such cases, income withholding shall be implemented if the non-custodial parent fails to make payments in an amount equal to one month’s support obligation, or the non-custodial parent requests immediate withholding, or the payee or the department requests that withholding begin and the non-custodial parent has failed to make a payment or payments on the date or dates due.

-From Section 30-3-61 of the Code of Alabama.

[/toggle] [toggle title=”Alabama Alimony Laws”]The following is a summary of Alabama alimony laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Alabama Code and/or consult with an attorney about how the law might apply to your particular situation.

Alimony Guidelines

(From Sections 30-2-51 through 30-2-55 of the Alabama Code)

(a) If either spouse has no separate estate or if it is insufficient for the maintenance of a spouse, the judge, upon granting a divorce, at his or her discretion, may order to a spouse an allowance out of the estate of the other spouse, taking into consideration the value thereof and the condition of the spouse’s family. Notwithstanding the foregoing, the judge may not take into consideration any property acquired prior to the marriage of the parties or by inheritance or gift unless the judge finds from the evidence that the property, or income produced by the property, has been used regularly for the common benefit of the parties during their marriage.

(b) The judge, at his or her discretion, may include in the estate of either spouse the present value of any future or current retirement benefits, that a spouse may have a vested interest in or may be receiving on the date the action for divorce is filed, provided that the following conditions are met:

(1) The parties have been married for a period of 10 years during which the retirement was being accumulated.

(2) The court shall not include in the estate the value of any retirement benefits acquired prior to the marriage including any interest or appreciation of the benefits.

(3) The total amount of the retirement benefits payable to the non-covered spouse shall not exceed 50 percent of the retirement benefits that may be considered by the court.

(c) If the court finds in its discretion that any of the covered spouse’s retirement benefits should be distributed to the non-covered spouse, the amount is not payable to the non-covered spouse until the covered spouse begins to receive his or her retirement benefits or reaches the age of 65 years, unless both parties agree to a lump sum settlement of the non-covered spouse’s benefits payable in one or more installments.

If the divorce is in favor of either spouse for the misconduct of the other spouse, the judge trying the case shall have the right to make an allowance to either spouse out of the estate of either spouse, or not make an allowance as the circumstances of the case may justify, and if an allowance is made, the misconduct of either spouse may be considered in determining the amount; provided, however, that any property acquired prior to the marriage of the parties or by inheritance or gift may not be considered in determining the amount.

Termination of Alimony upon Remarriage or Cohabitation

Any decree of divorce providing for periodic payments of alimony shall be modified by the court to provide for the termination of such alimony upon petition of a party to the decree and proof that the spouse receiving such alimony has remarried or that such spouse is living openly or cohabiting with a member of the opposite sex. This provision shall be applicable to any person granted a decree of divorce either prior to April 28, 1978, or thereafter; provided, however, that no payments of alimony already received shall have to be reimbursed.

[/toggle] [toggle title=”Alabama Property Division Laws”]The following is a summary of Alabama property division laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Alabma Code and/or consult with an attorney about how the law might apply to your particular situation.

Property and Liabilities of Wife

All property of the wife, held by her previous to the marriage or to which she may become entitled after the marriage in any manner, is the separate property of the wife and is not subject to the liabilities of the husband. The earnings of the wife are her separate property, but she is not entitled to compensation for services rendered to or for the husband or to or for the family. The wearing apparel of the wife, however acquired, is her separate property. All damages which the wife may be entitled to recover for injuries to her person or reputation are her separate property.

All property of the wife, whether acquired by descent or inheritance, or gift, devise or bequest, or by contract or conveyance, or by gift from or contract with the husband, is the separate property of the wife within the meaning of, and is subject to all the provisions of, this chapter, saving and excepting only such property as may be conveyed to an active trustee for her benefit.

The husband is not liable for the debts or engagements of the wife, contracted or entered into before marriage, or for torts committed by her before marriage, but she remains liable and suable therefor as if she were sole.

The husband is not liable for the debts or engagements of the wife, contracted or entered into after marriage, or for her torts in the commission of which he does not participate, but the wife is liable for such debts or engagements, or for her torts, and is suable therefor as if she were sole.

-From Sections 30-4-1 through 30-4-7 of the Alabama Code.

[/toggle]