The following is a summary of Florida divorce laws, and is by no means intended to be an all-inclusive description of what to expect in your particular case. In some cases, the exact text of the statute may have been simplified and/or modified to provide for easier understanding. For a more specific understanding of the laws, you should consult the full Florida Code and/or consult with an attorney about how the law might apply to your particular situation.

Florida Divorce Grounds

There are two causes for divorce records under Florida laws:

61.052

a. The marriage is irretrievably broken, or

b. Mental incapacity of one of the parties.

Florida Residency Laws

To meet the laws in Florida for residency requirements:

12.902(i)

At least one party must have lived in the state of Florida for at least six months before filing the divorce papers. You must have one of the following:

- A valid Florida license, Florida ID, or Florida voter registration card;

- An affidavit of corroborating witness; or

- Testimony from someone who will say that you have lived in Florida for at least 6 months.

How to file for divorce in Florida

Final Hearing

You must actually appear in court for the final divorce records hearing, and testify if the court deems necessary.

Learn more about the divorce procedure.

Waiting Period

After you file for divorce forms in Florida, laws require you to wait 20 days before a final judgment can be entered, unless the court shows that an injustice would occur by the waiting period.

-From 61.19 of the Florida Statutes.

[toggle title=”Alimony Laws in Florida”]Alimony Guidelines

61.08

Alimony can be permanent or rehabilitative. In determining a proper award of alimony or maintenance, the court may consider adultery and other circumstances in their award. The following alimony guidelines are established under Florida laws:

a. The standard of living established during the marriage.

b. The duration of the marriage.

c. The age and the physical and emotional condition of each party.

d. The financial resources of each party, the non-marital and the marital assets and liabilities distributed to each.

e. When applicable, the time necessary for either party to acquire sufficient education or training to enable such party to find appropriate employment.

f. The contribution of each party to the marriage, including but not limited to, services rendered in homemaking, child care, education, and career building of the other party.

g. All sources of income available to either party.

Rehabilitative Alimony – Case Law

Kristensen v. Kristensen (433 So.2d 598 Fla. 5th DCA 1983) …”In awarding rehabilitative alimony, there must be a specific finding by the trial court regarding the need for rehabilitation and a plan to do so. Rehabilitative alimony is from a financially able former spouse to a financially needy former spouse to assist the needy spouse in adjusting to a new life and to aid in obtaining new skills, education, and/or other rehabilitation.

Learn more about general alimony laws.

[/toggle] [toggle title=”Florida Child Custody Laws”]Joint Legal Custody and Florida Laws

The courts show preference for shared parental responsibility (joint legal custody) in Florida Statute 1.13(2)(b)1: “It is the public policy of this state to assure that each minor child has frequent and continuing contact with both parents after the parents separate or divorce, and to encourage parents to share the rights and responsibilities and joys of childrearing. After considering all relevant facts, the father of the child shall be given the same consideration as the mother in determining the primary residence of a child, irrespective of the age or sex of the child.”

…and in Florida Statute 61.13(2)(b): “The court shall order that the parental responsibility for a minor child be shared by both parents unless the court finds that shared parental responsibility (joint legal custody) would be detrimental to the child…”

Florida Laws on Best Interest of the Child

61.13(3)

When awarding child custody in Florida, the court will consider all factors affecting the welfare and interests of the child, including but not limited to:

a. The parent who is more likely to allow the child frequent and continuing contact with the non-custodial parent.

b. The love, affection, and other emotional ties existing between the parents and the child.

c. The capacity and disposition of the parents to provide the child with food, clothing, medical care, and other material needs.

d. The length of time the child has lived in a stable, satisfactory environment and the desirability of maintaining continuity.

e. The permanence, as a family unit, of the existing or proposed custodial home.

f. The moral fitness of the parents.

g. The mental and physical health of the parents.

h. The home, school, and community record of the child.

i. The reasonable preference of the child as to custody, if the court deems the child to be of sufficient intelligence, understanding, and experience to express a preference.

j. The willingness and ability of each parent to facilitate and encourage a close and continuous parent-child relationship between the child and the other parent.

k. Evidence that any party has knowingly provided false information to the court regarding a domestic violence proceeding.

l. Evidence of domestic violence or child abuse.

m. Any other fact not specifically expressed in these laws that the court considers to be relevant.

Parenting Course in Divorce

A parenting course is required by Florida laws for all couples with children who obtain a divorce in Florida.

Learn more about general child custody laws.

[/toggle] [toggle title=”Florida Child Support Laws and Divorce”]Calculating child support in Florida

Child support is calculated using Florida Statute 61.30. First, each parent’s net income is determined. “Net income” is defined as gross income minus allowable deductions.

“Gross income” includes the following:

- Salary or wages.

- Bonuses, commissions, allowances, overtime, tips, and other similar payments.

- Business income from sources such as self-employment, partnership, close corporations, and independent contracts. “Business income” means gross receipts minus ordinary and necessary expenses required to produce income.

- Disability benefits.

- All workers’ compensation benefits and settlements.

- Unemployment compensation.

- Pension, retirement, or annuity payments.

- Social security benefits.

- Spousal support received from a previous marriage or court ordered in the marriage before the court.

- Interest and dividends.

- Rental income, which is gross receipts minus ordinary and necessary expenses required to produce the income.

- Income from royalties, trusts, or estates.

- Reimbursed expenses or in kind payments to the extent that they reduce living expenses.

- Gains derived from dealings in property, unless the gain is nonrecurring.

Allowable deductions from gross income include:

- Federal, state, and local income tax deductions, adjusted for actual filing status and allowable dependents and income tax liabilities.

- Federal insurance contributions or self-employment tax.

- Mandatory union dues.

- Mandatory retirement payments.

- Health insurance payments, excluding payments for coverage of the minor child.

- Court-ordered support for other children which is actually paid.

- Spousal support paid pursuant to a court order from a previous marriage or the marriage before the court.

Both parents’ net income is added together and the basic child support obligation is determined using the chart found in the Florida Child Support Guidelines Worksheet. You can access the Florida Child Support Guidelines Worksheet here (in PDF format). Find the combined net monthly income of the parents and go across the column to find the number of minor, dependent children to find the basic child support obligation.

Florida child support laws regarding child care and health insurance

The amount paid for health insurance premiums for the child, as well as 75% of day care or child care costs incurred because of work or school can then be added to the minimum child support obligation.

Deviation from the Child Support Guidelines

The Florida Child Support Guidelines are considered to be correct in all cases. However, the court may adjust the minimum child support award according to Florida law, or may adjust either or both parents’ share of the minimum child support award, based on the following considerations:

1. Extraordinary medical, psychological, educational, or dental expenses.

2. Independent income of the child, not to include moneys received by a child from supplemental security income.

3. The payment of support for a parent which regularly has been paid and for which there is a demonstrated need.

4. Seasonal variations in one or both parents income or expenses.

5. The age of the child, taking into consideration the greater needs of older children.

6. Special needs, such as costs that may be associated with the disability of a child, that have traditionally been met within the family budget even though the fulfilling of those needs will cause the support to exceed the proposed guidelines.

7. Total available assets of the obligee, obligor, and the child.

8. The impact of the Internal Revenue Service dependency exemption and waiver of that exemption. The court may order the primary residential (custodial) parent to execute a waiver of the Internal Revenue Service dependency exemption if the non-custodial parent is current in child support payments.

9. When calculation of the child support guidelines requires a person to pay another person more than 55% of his or her gross income for a current child support obligation resulting from a single support order.

10. The particular shared parental arrangement, such as where the child spends a significant amount of time, but less than 40 percent of the overnights, with the non-custodial parent, thereby reducing the financial expenditures incurred by the primary residential parent; or the refusal of the non-custodial parent to become involved in the activities of the child.

11. Any other adjustment which is needed to achieve an equitable result which may include, but not be limited to, a reasonable and necessary existing expense or debt which the parties jointly incurred during the marriage.

For incomes falling below the child support guidelines, a calculation will be made on a case-by-case basis.

-From 61.30(11)(a) of the Florida Statutes.

Florida Child Support Laws and Higher Education Expenses

“Absent a finding of physical or mental deficiencies, there is no legal duty to pay child support beyond the age of eighteen. Even though most parents willingly assist their adult children in obtaining a higher education, any duty to do so is a moral rather than a legal one, absent either a finding of legal dependence or a binding contractual agreement by the parent to pay such support.”

– From Carlton v. Carlton, CASE NO. 2D01-893, COURT OF APPEAL OF FLORIDA, SECOND DISTRICT, May 17, 2002.

Links:

Florida Child Support Enforcement Program

Florida Child Support Calculator

[/toggle] [toggle title=”Florida Divorce Law on Property Division”]What is defined as marital or non-marital

“Marital assets and liabilities” include:

- Assets acquired and liabilities incurred during the marriage, individually by either spouse or jointly by them;

- The enhancement in value and appreciation of non-marital assets resulting either from the efforts of either party during the marriage or from the contribution to or expenditure thereon of marital funds or other forms of marital assets, or both;

- Interspousal gifts during the marriage;

- All vested and nonvested benefits, rights, and funds accrued during the marriage in retirement, pension, profit sharing, annuity, deferred compensation, and insurance plans and programs; and

- All real property held by the parties as tenants by the entireties, which acquired prior to or during the marriage, shall be presumed to be a marital asset. If, in any case, a party makes a claim to the contrary, the burden of proof shall be on the party asserting the claim for a special equity.

“Non-marital assets and liabilities” include:

- Assets acquired and liabilities incurred by either party prior to the marriage, and assets acquired and liabilities incurred in exchange for such assets and liabilities.

- Assets acquired separately by either party by interspousal gift, bequest, devise, or descent, and assets acquired in exchange for such assets.

- All income derived from non-marital assets during the marriage unless the income was treated, used, or relied upon by the parties as a marital asset; and

- Assets and liabilities excluded from marital assets and liabilities by valid written agreement of the parties, and assets acquired and liabilities incurred for such assets and liabilities.

Cutoff date for valuation

The cutoff date for determining assets and liabilities to be identified or classified as marital assets and liabilities is the earliest of the following: the date the parties enter into a valid separation agreement, another date established by the separation agreement, or the date of the filing of a petition for dissolution of marriage.

Equal distribution

The court must begin with the premise that the distribution should be equal, unless there is a justification for an unequal distribution based on all relevant factors, including:

(a) The contribution to the marriage by each spouse, including contributions to the care and education of the children and services as homemaker.

(b) The economic circumstances of the parties.

(c) The duration of the marriage.

(d) Any interruption of personal careers or educational opportunities of either party.

(e) The contribution of one spouse to the personal career or educational opportunity of the other spouse.

(f) The desirability of retaining any asset, including an interest in a business, corporation, or professional practice, intact and free from any claim or interference by the other party.

(g) The contribution of each spouse to the acquisition, enhancement, and production of income or the improvement of, or the incurring of liabilities to, both the marital assets and the non-marital assets of the parties.

(h) The desirability of retaining the marital home as a residence for any dependent child of the marriage, or any other party, when it would be equitable to do so, it is in the best interest of the child or that party, and it is financially feasible for the parties to maintain the residence until the child is emancipated or until exclusive possession is otherwise terminated by a court of competent jurisdiction. In making this determination, the court shall first determine if it would be in the best interest of the dependent child to remain in the marital home; and, if not, whether other equities would be served by giving any other party exclusive use and possession of the marital home.

(i) The intentional dissipation, waste, depletion, or destruction of marital assets after the filing of the petition or within 2 years prior to the filing of the petition.

(j) Any other factors necessary to do equity and justice between the parties.

Learn more about general property division in divorce or common ways to divide your property.

[/toggle] [toggle title=”Download Free Florida Divorce Forms PDF (Dissolution of Marriage)”]Petition for Dissolution of Marriage | 12.901 | Forms A – B3

- (a) Petition for Simplified Dissolution of Marriage – 02/2018 (Fillable form coming soon)

RTF / PDF - (b)(1) Petition for Dissolution of Marriage with Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (b)(2) Petition for Dissolution of Marriage with Property but No Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (b)(3) Petition for Dissolution of Marriage with No Dependent or Minor Child(ren) or Property – 02/2018 (Fillable form coming soon)

RTF / PDF

Additional Supporting Documents | 12.902 | Forms B – J

- (b) Family Law Financial Affidavit (Short Form) -01/2015

RTF / PDF / Web Form - (c) Family Law Financial Affidavit – 01/2015

RTF / PDF / Web Form - (d) Uniform Child Custody Jurisdiction and Enforcement Affidavit – 02/2018 (Fillable form coming soon)

RTF / PDF - (e) Child Support Guidelines Worksheet – 09/2012

RTF / PDF / Web Form - (f)(1) Marital Settlement Agreement for Dissolution of Marriage with Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (f)(2) Marital Settlement Agreement for Dissolution of Marriage with Property but No Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (f)(3) Marital Settlement Agreement for Simplified Dissolution of Marriage – 10/2017

RTF / PDF - (i) Affidavit of Corroborating Witness – 02/2018 (Fillable form coming soon)

RTF / PDF - (j) Notice of Social Security Number – 11/2015

RTF / PDF / Web Form

Answers to Dissolution | 12.903 Forms A – E

- (a) Answer, Waiver, and Request for Copy of Final Judgment of Dissolution of Marriage – 02/2018 (Fillable form coming soon)

RTF / PDF - (b) Answer to Petition for Dissolution of Marriage – 02/2018 (Fillable form coming soon)

RTF / PDF - (c)(1) Answer to Petition and Counterpetition for Dissolution of Marriage with Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (c)(2) Answer to Petition and Counterpetition for Dissolution of Marriage with Property but No Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (c)(3) Answer to Petition and Counterpetition for Dissolution of Marriage with No Dependent or Minor Child(ren) or Property – 02/2018 (Fillable form coming soon)

RTF / PDF - (d) Answer to Counterpetition – 02/2018 (Fillable form coming soon)

RTF / PDF - (e) Answer to Supplemental Petition – 02/2018 (Fillable form coming soon)

RTF / PDF

Petition for Support Unconnected with Dissolution | 12.904 Forms A – B

- (a)(1) Petition for Support Unconnected with Dissolution of Marriage with Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (a)(2) Petition for Support and Parenting Plan Unconnected with Dissolution of Marriage with Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF - (b) Petition for Support Unconnected With Dissolution of Marriage with No Dependent or Minor Child(ren) – 02/2018 (Fillable form coming soon)

RTF / PDF

Supplemental (Modification) Petitions | 12.905 Forms A – D

- (a) Supplemental Petition to Modify Parenting Plan/Time-Sharing Schedule and Other Relief – 11/2015 (Fillable form coming soon)

RTF / PDF - (b) Supplemental Petition for Modification of Child Support – 11/2015 (Fillable form coming soon)

RTF / PDF - (c) Supplemental Petition for Modification of Alimony – 11/2015 (Fillable form coming soon)

RTF / PDF - (d) Supplemental Petition for Temporary Modification of Parenting Issues for Child(ren) of Parent Activated, Deployed, or Temporarily Assigned to Military Service – 11/2015

RTF / PDF

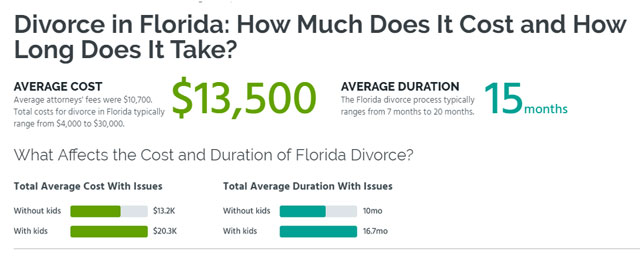

According to our survey results, the average divorce in Florida cost $13,500, including $10,700 in attorneys’ fees.

The average hourly fee charged by Florida divorce lawyers was $260 per hour. Our readers in Florida, however, reported a wide fluctuation in their divorce lawyers’ hourly rates—some were charged as little as $150 per hour, while others paid as much as $450 per hour.

Most Florida divorce attorneys bill on an hourly basis. So, the attorney’s hourly rate—plus the rate of any paralegals and other firm staff—factored with the time spent on your divorce case will determine the amount of attorneys’ fees you’ll pay.

After attorneys’ fees, the rest of divorce costs come from expenses, which includes fees for court filings, mediation, and the cost of copying and serving documents. Expenses also include compensation for expert witnesses and consultants, such as child custody evaluators, appraisers, or financial analysts. Average expenses in Florida divorces were $2,800.

A Florida divorce where the spouses are able to work through their concerns amicably can cost much less than the average, while a divorce with hotly disputed issues and accusations that need to be substantiated will cost more than the average.

Arguing Over Child Custody

Florida divorce cases involving children can be costly. According to our survey results, cases that involved child custody and support issues cost an average $20,300 to resolve, including $17,100 in attorneys’ fees. Compare these numbers to divorces without children in Florida, where the average cost dropped to $13,200, including $9,700 in attorneys’ fees.

Child custody disputes tend to be expensive because they’re often the most emotionally charged and therefore, the most challenging to settle. Parents may request, or a judge may order, a custody evaluation, which takes time, money, and court involvement.

Going to Trial

Trials are expensive because of the increased amount of time your attorney has to prepare for court (drafting pre-trial motions and trial briefs, additional discovery, preparing for witness testimony, preparing opening and closing statements) plus the full days in court. Fees for expert witness testimony add to the expense.

Source: lawyers.com

[/toggle]